George Prazmowski

Sales Representative

Phone: 613.725.1171 Email

Buying or selling a home is a big decision - you need an experienced professional to guide you through the process. When you work with me, you can count on personal, attentive, patient service, excellent knowledge of the area, great negotiation skills and expert selling strategies. I've been helping clients buy and sell homes and condominiums across the Ottawa region and would be pleased to work with you.

Featured Properties

Listing # X12386751 | $289,900

House | For Sale

59 DROHAN STREET , Madawaska Valley, Ontario

Barry's Bay 3-Bedroom Home Close to Schools, Shopping, and Healthcare!! Welcome to this move-in ready home in Barry's ...

Listing # X12394587 | $1,099,000

Investment | For Sale

1991 BANFF AVENUE , Ottawa, Ontario

Exceptional Investment Opportunity - Live In One Unit, Rent the Other! Discover the perfect blend of functionality, ...

Listing # X12694614 | $1,999,888

House | For Sale

3886 ARMITAGE AVENUE , Ottawa, Ontario

This gorgeous 5 bedroom, 3 bathroom waterfront home is truly one of a kind. Enter into the foyer and immediately be ...

Ottawa Real Estate Listings to July 30,2023 Trending Lower than Previous Years...

Ottawa 2022 Market Summary

From the attached graphs you'll see that we had an interesting bump in new property listings in the final week of the year....perhaps showing that Sellers are anxious to get properties on the market and get the Selling/Buying season off to a good start. This bump is also reflected in the number of properties sold in the last week....while down over the year, the number does match the sales for the same period in 2019. Finally, prices for the ending of the year did hold steady, matching those in 2021....no great crash in sold prices for the Ottawa area.

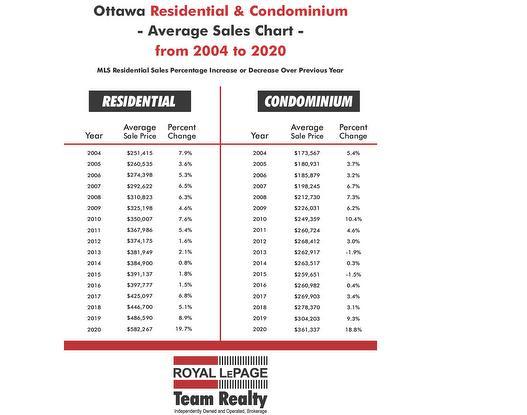

Residential & Condo Yearly Price Movements for Ottawa

A stable market for real estate value

The results are in for 2020....with some wild movement in 2020, the Ottawa Real Estate market showed some significant price appreciation for residential & condo properties. In the past, price increases have been fairly stable, with some occasional spikes....in fact, since 1956, there have only been three years when the overall market has shown a decrease in average prices.

Royal LePage House Price Survey for the Fourth Quarter of 2018

Key highlights from the national release include:

- The price of a home in Canada increased 4.0 per cent year-over-year to $631,223 in the fourth quarter of 2018, continuing the recovery from the most significant housing correction since the financial crisis. Condominiums continued to see the highest rate of appreciation nationally when compared to the detached segment, rising 7.2 per cent year-over-year to $447,915.

- The Canadian economy is performing well overall, with pockets of uncertainty. Persistently weak oil prices driven by domestic market access bottlenecks and global supply gluts have hit Western Canada hard, and trade tensions between China and the U.S. in particular are impacting consumer confidence across the continent.

- The GTA was a story of contrasts. The City of Toronto experienced a strong rebound in the fourth quarter, while the surrounding areas remained relatively weak year-over-year. Prices in Toronto saw sizable increases, rising 8.8 per cent compared to 3.4 per cent gains for the GTA more broadly.

- The aggregate price of a home in the Greater Montreal Area passed the $400,000 mark, rising to $407,230, an increase of 4.1 per cent from the same period last year. This represents a higher rate of appreciation than that seen in both the GTA and Greater Vancouver, and above the national aggregate percentage increase.

- Home price appreciation in Greater Vancouver grew at a modest pace rising 2.1 per cent in the fourth quarter from the year before, to an aggregate price of $1,274,831. More affordable suburbs like Langley, Surrey, and Coquitlam that had seen double digit price growth in previous quarters grew at a more modest pace rising 2.4 per cent, 2.3 per cent, and 0.4 per cent respectively.

CMHC 1Q 2018 HOUSING MARKET ASSESSMENT Shows Low Vulnerability for Ottawa Market

Ottawa: Low degree of vulnerability - We detect low evidence of overbuilding in Ottawa as the

number of completed and unsold condominium apartments has been steadily declining since mid-2016, pointing to improved demand conditions for such dwellings. The decline in condominium apartment starts activity over the last two years translated into significantly lower completions in 2017 compared to recent highs, easing up the inventory overhang.

Demand for resale condo apartments also expanded strongly in recent months. We detect low evidence for all other indicators of vulnerability as the Ottawa market is supported by steady employment and earnings growth.